The Break-even Level Out Output Occurs for a Business When

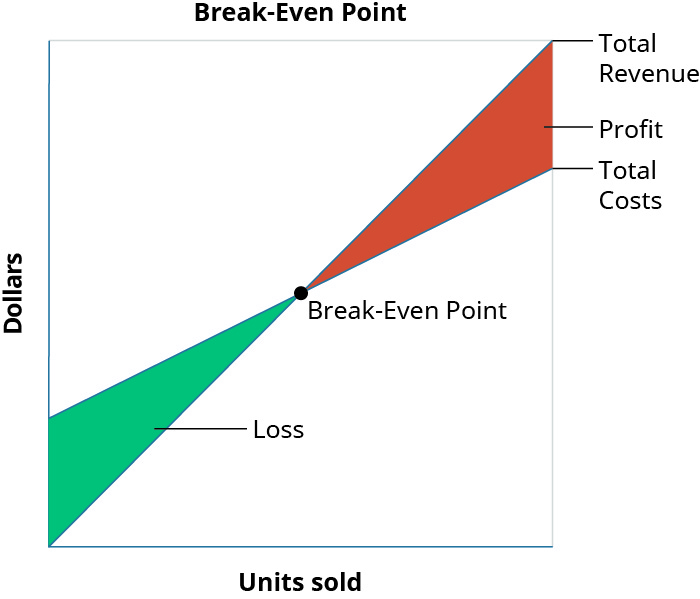

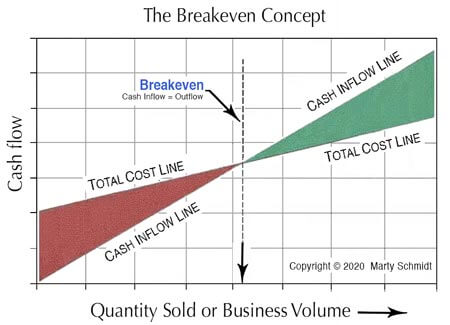

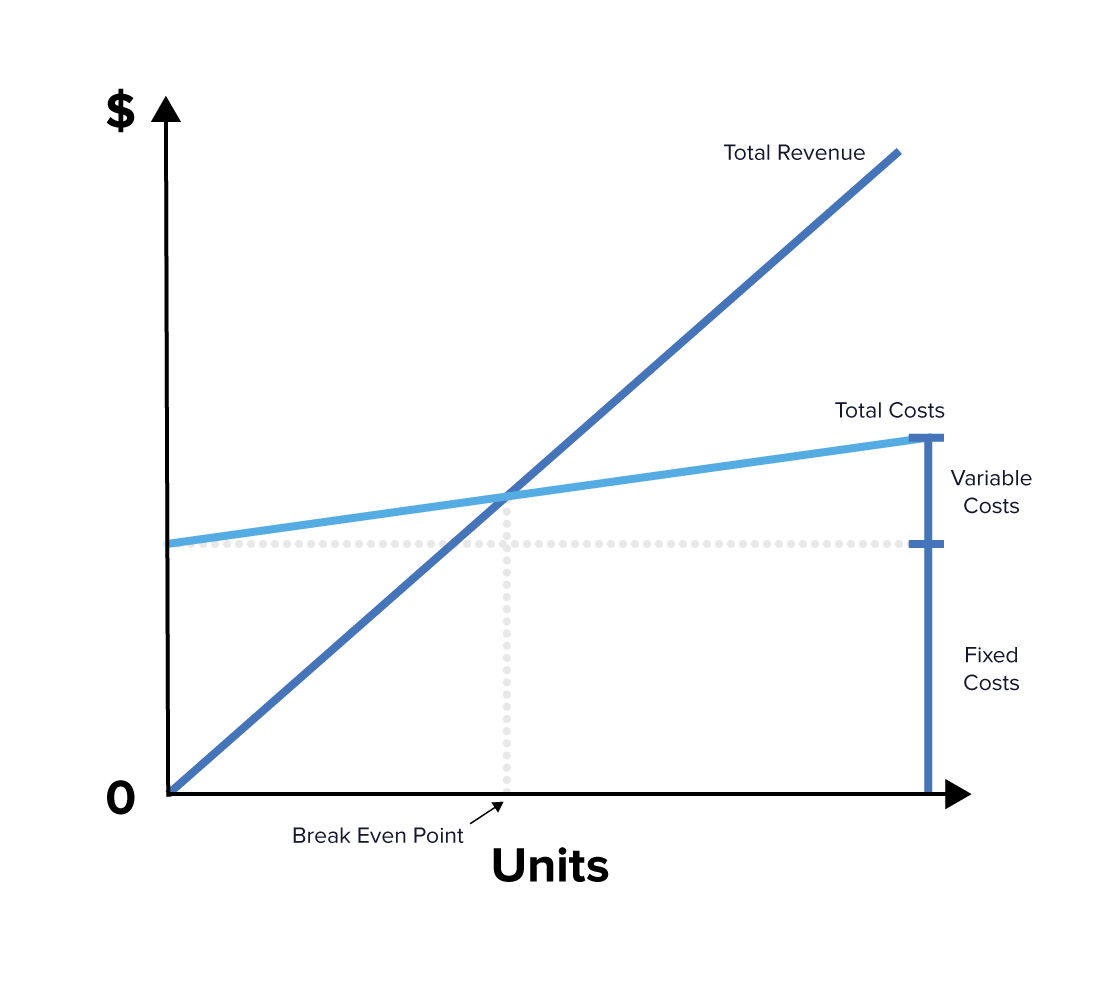

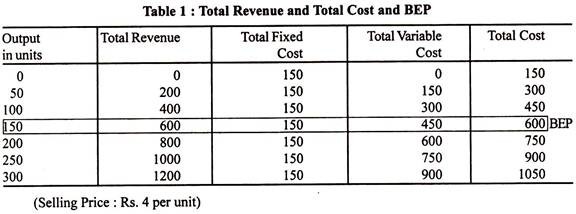

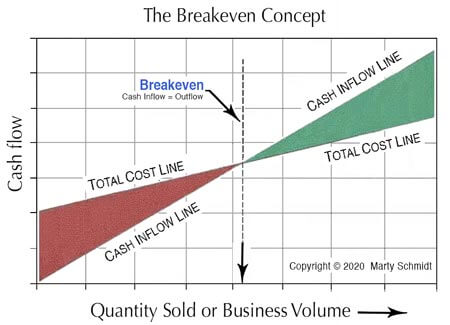

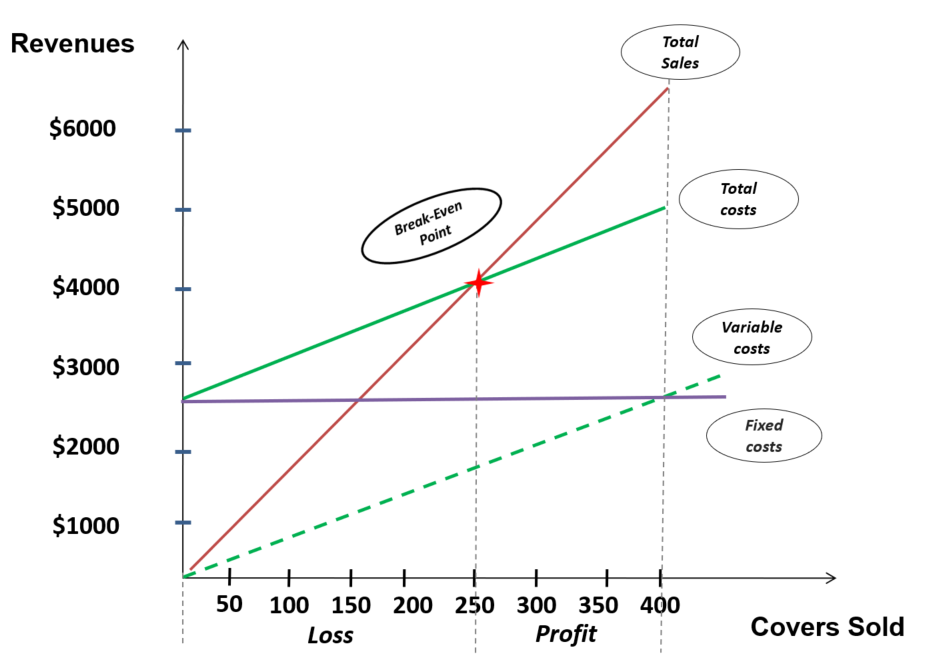

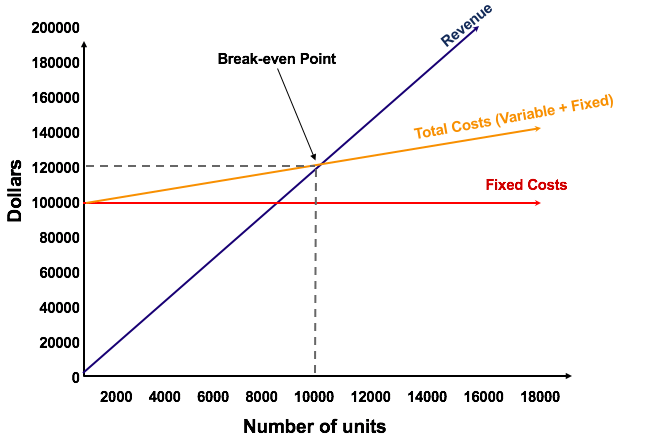

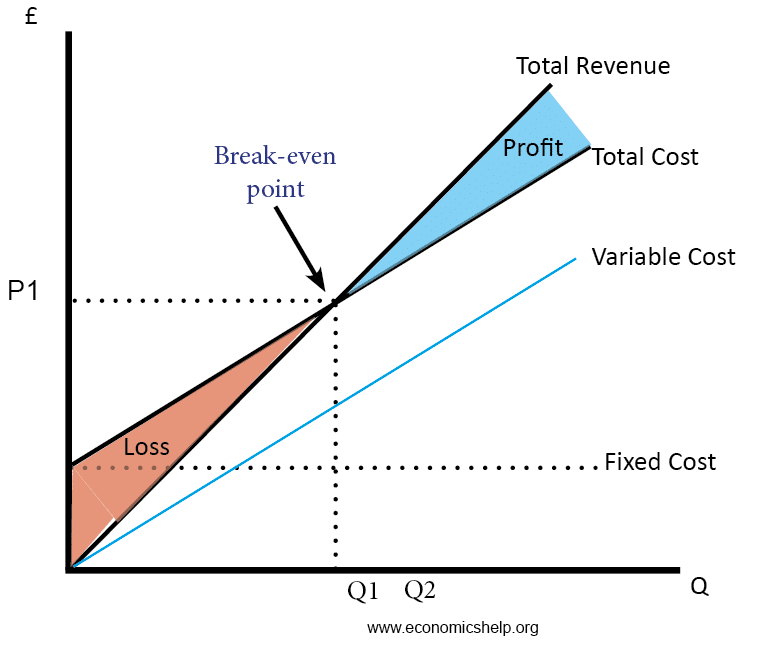

Break-even analysis is a methodology for finding break-even volume by analyzing relationships among fixed and variable costs. The break-even point may be defined as that point of sales volume at which total revenue is equal to total cost.

Calculate A Break Even Point In Units And Dollars Principles Of Accounting Volume 2 Managerial Accounting

11th - 12th grade.

. All of the above. Up to 24 cash back What is a Break-Even Analysis. The break-even point in economics businessand specifically cost accountingis the point at which total cost and total revenue are equal ie.

2 The break-even level out output occurs for a business when. The occurrence of drought conditions in the corn market will. The level of output at which total revenue is equal to total costs of porduction.

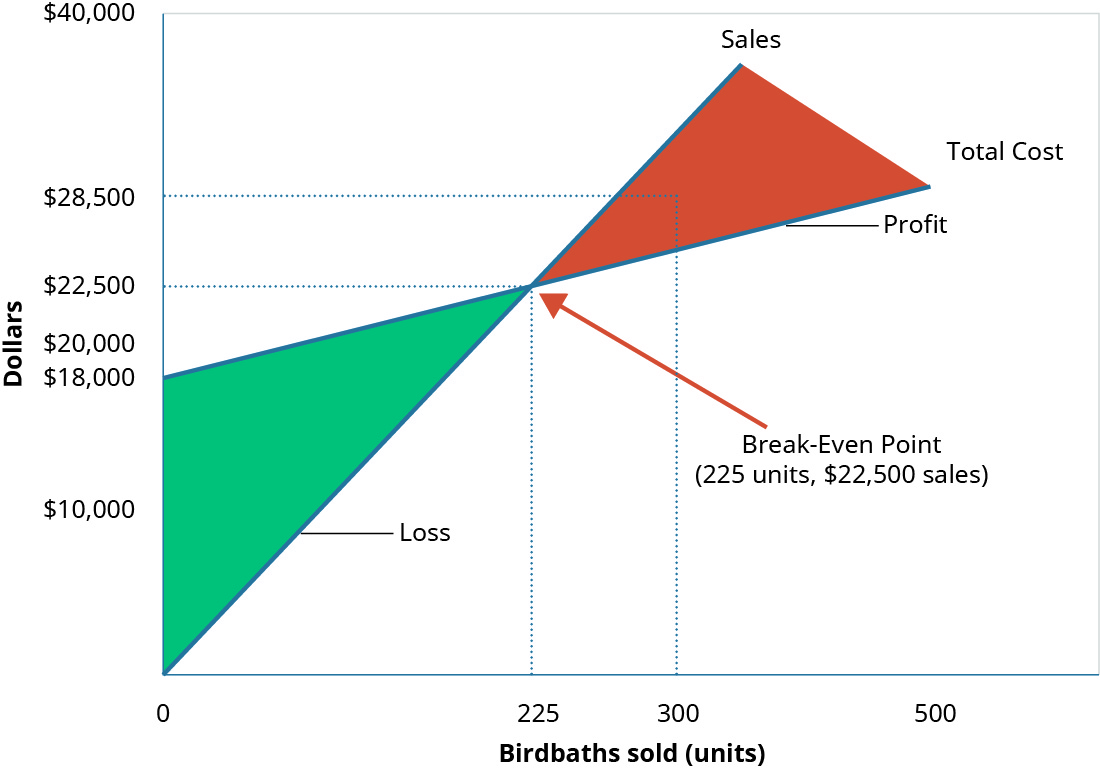

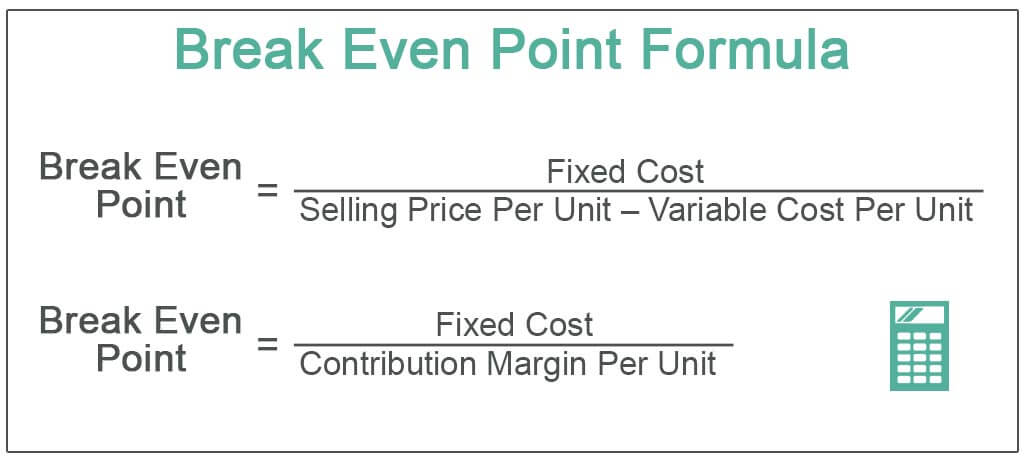

There is no net loss or gain and one has broken even though opportunity costs have been paid and capital has received the risk-adjusted expected return. In short all costs that must be paid are paid and there is neither profit or loss. Break-even output units Fixed costs Contribution per unit So break-even output 40000 divided by 6 6666 units.

To calculate break-even point based on units. Break-even is a key objective of new and unestablished firms. Therefore the concept of break even point is as follows.

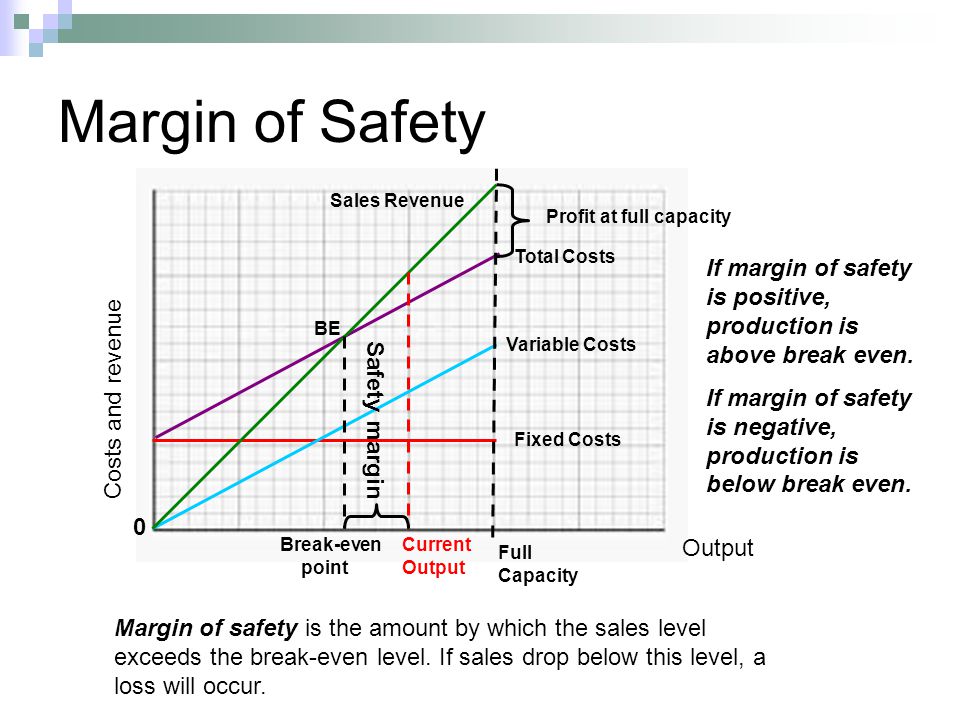

All of the above. The difference between the actual output and the breakeven level is known as the. In other words a firm is just breaking even The total revenue received by a firm at the breakeven output just matches the total cost incurred.

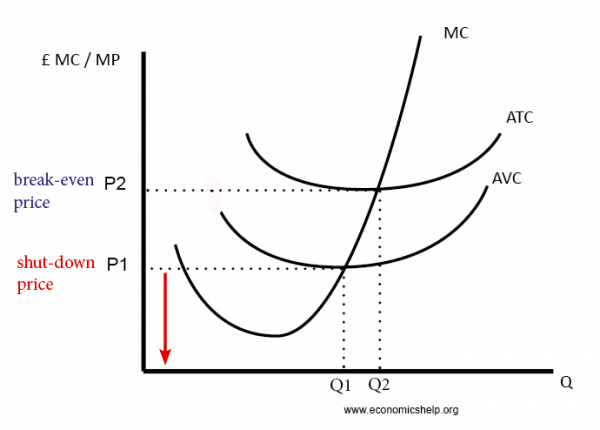

A business is said to break-even when its total sales are equal to its total costs. Now apply the classic formula for calculating breakeven output. B Average revenue equals average variable cost.

C The producers decision in 2013 is to supply 100 units of output. Calculating your break-even point. Break-even point BEP is a term in accounting that refers to the situation where a companys revenues and expenses were equal within a specific accounting period Fiscal Year FY A fiscal year FY is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual.

There are two basic formulas for determining a businesss break-even point. This is useful information since it. Break Even Analysis Knowledge Check.

The fixed costs are those that do not. D Marginal cost equals marginal revenue. This occurs at the level of output where total costs equal total revenue ie.

Break-even level of output. D None of the above. 1001 - 050 200 units b.

Play this game to review Business. The difference between the actual output and the breakeven level is known as the. So break-even output 6666 units.

This produces a dollar figure that a company needs to break even. What is the break-even level of output if fixed costs increase to 180 and variable costs decline to 040 per unit. The break-even point refers to that level of output which evenly breaks the costs and revenues and hence the name.

Breakeven output is a production level that achieves zero economic profit. Introduction to Break-even Analysis. The number of units that a business needs to sell in order to cover their total costs from their total revenue is called the break-even level of output.

Therefore the break even point is often referred to as the no-profit or no-loss point The break even analysis is important to business owners and managers in determining how many units or revenues are needed to cover fixed and variable expenses of the business. Break-even fixed costs selling price variable costs The result of this calculation is always how many products a business needs to sell in order to break even. The other is based on points on sales in GBP.

A new market entrant will affect the level of demand. The break-even level out output occurs for a business when O Marginal revenue equals average total cost. C Average revenue equals marginal revenue.

Business Maths - Breakeven Analysis - the Margin of Safety Student Videos. Hence businesses need to pay careful attention to their cash-flow situation by monitoring and controlling the. It is a point of no profit no loss.

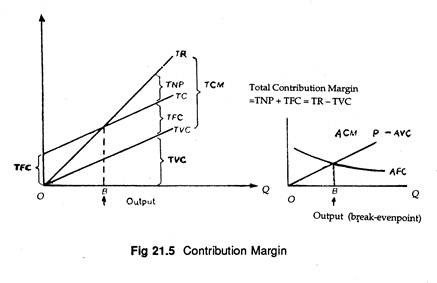

Divide fixed costs by the revenue per unit minus the variable cost per unit. A Marginal revenue equals average total cost. Break-even analysis is an analytical approach for determining the level of output and sales volume at which a business breaks even.

D Marginal revenue equals average total cost. BAverage revenue equals marginal revenue. Marginal cost equals marginal revenue.

The break-even level out output occurs for a business when a Marginal cost equals marginal revenue. Result in a deadweight loss to society. The break-even level of output occurs for a business when.

Increase the price of corn. However because total cost includes a. It means that there were no net profits or no net.

Break-even level of output. The casual dining crunch. One is based on the number of units of products sold.

Marginal revenue equals average total cost. Profit when Revenue Total Variable cost Total. 1801 - 040 300 units.

In accounting and business the breakeven point BEP is the production level at which total revenues equal total expenses. Breakeven analysis Break-even point occurs where total revenues equal total costs Total revenues Total costs Fixed costs Total variable costs let b the number of units of output at breakeven point then b Sales revenue per unit Fixed costs b Variable costs per unit giving unit per cost Variable - unit per price selling revenue Sales costs Fixed b. Break-even output is always expressed in terms of units.

What is a business doing at the break even point. The term Break-Even Point refers to the exact business volume at which total cash outflows equals total cash inflowsFor this reason the break-even point is also called Break-Even VolumeAt break-even net cash flow equals zero. The calculation in.

CAverage revenue equals average variable cost. A business breaks even when neither a profit nor a loss is made. Average revenue equals average variable cost.

Preview this quiz on Quizizz.

Break Even Analysis With Diagram

Break Even Price Economics Help

Break Even Analysis An Overview Sciencedirect Topics

Break Even Analysis Decision Making Skills Training From Mindtools Com

Break Even Analysis An Overview Sciencedirect Topics

Break Even Point Of A Firm Meaning Determination And Types

Find Break Even Point Volume In 5 Steps From Costs And Revenues

5 3 Break Even Analysis Chapter Ppt Video Online Download

Chapter 15 Cost Volume Profit Cvp Analysis And Break Even Point Introduction To Food Production And Service

Break Even Analysis With Diagram

Tutor2u Operations Introduction To Break Even Analysis

Calculate A Break Even Point In Units And Dollars Principles Of Accounting Volume 2 Managerial Accounting

Break Even Analysis Learn How To Calculate The Break Even Point

Break Even Point In Accounting Formula Calculation

What Is Break Even Point Analysis Formula And Template 2022

Break Even Analysis An Overview Sciencedirect Topics

Comments

Post a Comment